Our job? Protect your purpose.

Voluntary Benefits Designed for Nonprofits

eMobenefits provides critical support to employees when the unexpected happens — whether it’s an accident, illness, or injury. Voluntary benefits help pay for out-of-pocket expenses that major medical and other insurance don’t cover.

Why choose eMobenefits for your voluntary benefits partner?

Empowerment Through Education

Purpose Before Profits

Ongoing Support and Guidance

1-to-1 Benefits Counseling For Everyone

Benefits Designed for Nonprofits

Partner First Mindset

Easy Enrollment and Administration

There is no requirement for a minimum number of employees

Voluntary benefits available for your team with eMobenefits.

Life Insurance

Critical Illness

Personal Accident

Cancer Coverage

Vision Care

Dental Care

Short Term Medical

Telehealth

%

Nearly 66% of employees who were satisfied with their benefits reported being more productive.*

%

Some 70% of employees say they need their employer’s help to ensure they are healthy 70 and financially secure.*

%

Over 80% of employees said benefits through their employer contribute to their feelings of financial security.*

What are voluntary benefits?

Voluntary benefits help pay for out-of-pocket expenses that major medical and other insurance don’t cover. Also called supplemental benefits, voluntary benefits are used to meet a diverse range of needs.

Employees often choose voluntary benefits, contributing personally, to enhance their standard health insurance and bolster their overall financial protection plan.

This additional financial support acts like a safety net, helping cover expenses that regular health insurance may overlook, such as bills or everyday costs.

Helping Nonprofits Fulfill Their Missions

Adding voluntary benefits to your compensation package supports your nonprofit and its employees, fostering increased satisfaction and productivity within your team.

Low-Cost Benefit Solutions

No Employee Minimum

Easy Set-up with Minimal Disruption

Customized Benefit Packages

Large Company Benefits

Strengthen Financial Security

Real Guidance from Real People

Provide benefits that make a real impact

Life Insurance

Life insurance provides a financial safety net for loved ones in the event of the employee’s death.

Critical Illness

Cash benefits for covered critical conditions, such as heart attack, stroke, cancer, or major organ transplant.

Personal Accident

Accident insurance plans offer assistance in covering unforeseen medical expenses arising from a covered accidental injury.

Cancer Coverage

Cancer insurance provides cash benefits to help with out-of-pocket expenses associated with a cancer diagnosis.

Vision Care

Vision insurance is designed to cover essential eye care services, including eye exams, glasses, and contact lenses.

Dental Care

Dental insurance covers both routine and costly dental procedures typically excluded from standard health insurance.

Short-term Medical

Short-term medical insurance provides a limited-duration medical insurance solution until a qualified health plan is chosen, helping reduce your financial risk.

Telehealth

Telemedicine solution for non-emergency illnesses and general care. Have direct access to fully credentialed doctors, via phone or video consultations.

Health Discount Program

Wellness cards offer discounts on health and wellness-related expenses, which may include prescription drugs, preventive screening, and other wellness services.

Advantages for your nonprofit

Nonprofits strengthen their organization and support employee coverage needs through the advantages of voluntary benefits.

Have a big impact at little to no cost

Providing valuable coverage at affordable rates can have a big impact on your employees’ lives. What’s more, you can offer voluntary benefits (for example, 100% employee-paid) without adding costs to your bottom line.

Less disruption with simple enrollment

We have enrollment choices that can be tailored to fit jobsite conditions and the unique needs of your team. This ensures a seamless and personalized experience, fostering a positive and supportive environment for your workforce. With adaptable options, we aim to make the enrollment process as convenient and accommodating as possible for every member of your team.

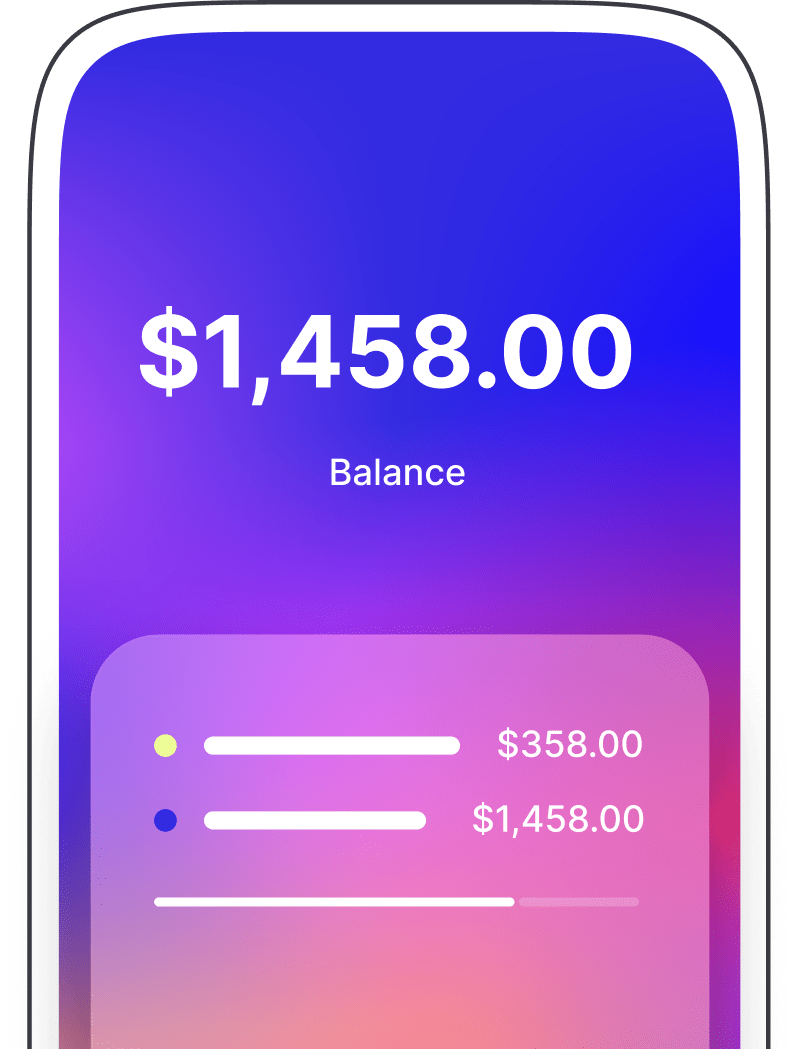

Easy-to-use benefits administration

We get it – managing employees’ voluntary benefits can be a concern. But guess what? Choosing a partner like eMobenefits, who’s totally on the same page as you and offers benefits enrollment, administration, and HR tech solutions, is a surefire way to make a positive impact without breaking the bank.

Guidance regardless of team size

For nonprofits, receiving guidance on benefits is essential, regardless of team size. EmoBenefits understands this and is committed to providing support to organizations of all sizes. Because at the end of the day, everyone deserves access to big-time benefits that make a meaningful impact on their well-being.

Helping Nonprofits attract and retain talent

For nonprofits grappling with competition against larger companies for talent, boasting deeper pockets, incorporating eMobenefits’ voluntary offerings levels the playing field, making your organization a compelling choice for prospective employees.

Advantages for your employees

Voluntary benefits play a key role in helping employees sustain both their health and financial well-being.

Valuable protection at affordable rates

Our voluntary benefits are often available at affordable rates, providing workers with options not easily found on the individual market. Additionally, the opportunity to pay premiums with pre-tax dollars and through payroll deductions makes it simple and convenient for employees to save money.

Fill gaps in major medical benefits

Incorporating voluntary benefits like accident, cancer, and critical illness coverage can provide a financial safety net. These benefits help alleviate the impact of out-of-pocket expenses such as deductibles, coinsurance, and travel costs that may not be covered by their primary medical plan.

Confidence in the benefits provided

Many employees struggle to find time to research and understand their benefit options. Employer-sponsored voluntary benefits offer a solution, ensuring that both the carrier and benefits have been thoroughly vetted. Additionally, personalized guidance is often available to assist workers in making informed choices tailored to their needs.

Focused on financial and overall wellness

EmoBenefits places a strong emphasis on both financial security and employee wellness. This dual focus on financial well-being and overall wellness contributes to a more resilient and satisfied workforce. By offering a range of voluntary benefits, we empower organizations to prioritize their employees’ financial health, ensuring they have a safety net for unforeseen expenses.

Popular enrollment options at a glance

Our personalized approach to enrollment prioritizes that everyone is well-informed, engaged, and protected.

Easier Enrollment

No enrollment challenge is too great — whether you’re multi-site, multi-lingual or multi-shift. eMobenefits has it covered.

EmoEnroll [Online Self-Service]

At their conveniance, an employee uses an online system such as a benefits portal or benefits website for enrollment.

In-person

If available in your region, a benefits advisor meets with an employee at the worksite in a 1-to-1 counseling session.

Telephonic

A benefits counselor connects with an

employee in a 1-to-1 counseling session by telephone at a convenient time.

employee in a 1-to-1 counseling session by telephone at a convenient time.

Group Meetings

Employee attends a group meeting with their co-workers (in person or virtually) as a lead-up to 1-to-1 counseling.

Virtual

Just like virtual conferencing, a benefits advisor meets with an employee in a 1-to-1 session using virtual enrollment tools.

Offer our voluntary benefits

If you’re curious about our voluntary benefits, let’s chat – no strings attached! We’re here to help your employees tackle unexpected costs tied to rising medical bills and make sure they get the benefits they really want and need.

Busting myths about nonprofits

Many nonprofits may not realize they can tap into various voluntary benefits. They assume they are too expensive, too complicated, or not needed.

None of those are true.

Myth: Nonprofits believe they can’t afford to pay for voluntary benefits.

Voluntary benefits can be partially funded or even fully funded by the employee, granting nonprofits complete control over their budget and the flexibility to choose the options that best suit their organization and employees.

Myth: Not enough employees to qualify.

Depending on the benefits carrier and type of coverage, most nonprofits with fewer than 5 employees can qualify for many types of voluntary benefits. And some carriers don’t have any minimum staffing requirements at all. Also, we can provide options where nonprofits just introduce our products and have nothing to do with administering a benefits program at all.

Myth: Providing a voluntary benefits plan is costly and time-consuming.

Many voluntary benefits can be paid with pre-tax income which can save employers and their workers money. Additionally, some carriers may offer tools and technology that help make managing benefits simple.

Myth: Employees don’t value them.

While most nonprofits believe employees prioritize take-home pay over benefits, it’s crucial to note that employees often value nonmedical insurance benefits and voluntary benefits more than employers may realize. Recognizing and investing in these benefits can contribute significantly to employee satisfaction and overall well-being.